‘Why Hindenburg omen’ turned silent?

By Krishnamurthy

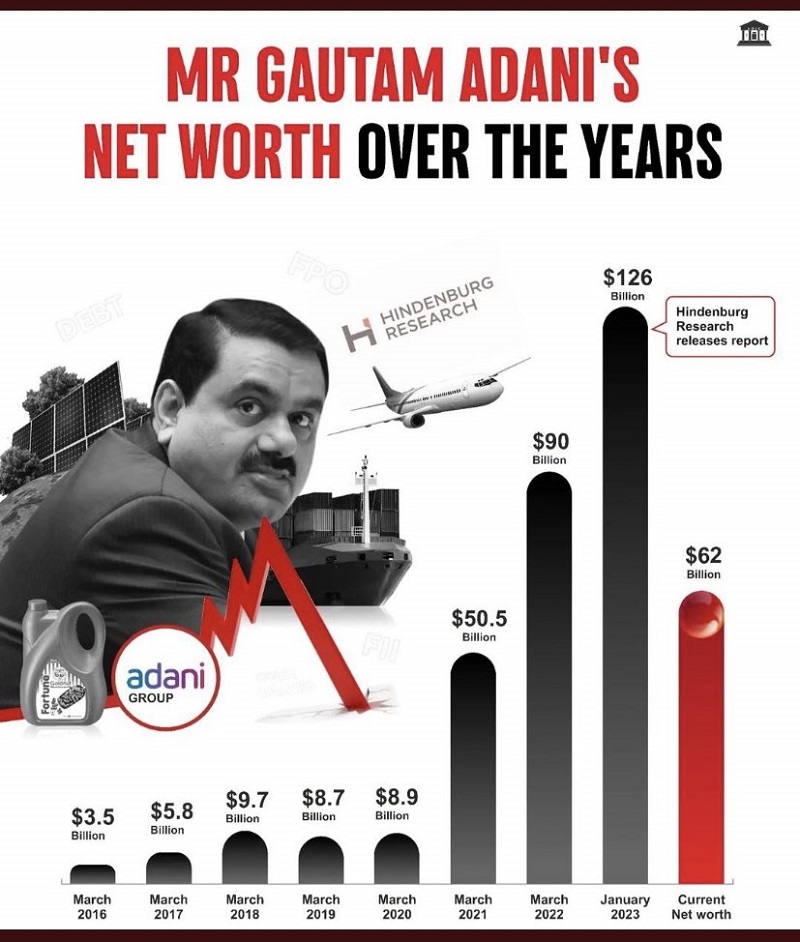

SVB AND THREE BANKS FELL- Ultra right Sangies screamed. Their hearts were already bleeding due the humpty dumpty fall their mammon demi-god, Mr. Adani. That too, because of a research report of an unknown small firm in USA.

To them, today, everyone seems to be the conspirators, even their own shadows, now they fear. Their intellectual bankruptcy, or their blind sycophancy, flared a fire work, linking Xi Jinping, President of People’s Republic of China, BBC Corporation, George Soro a billionaire from USA, a French Advocate firm, Mediapart an investigative journal, who filed a case reopening the Rafael deal and bribery paid by Dassault corporation . They are blind to truth or devotees of their human gods, but they are wise to collect their toll properly.

It is well predicted that 2023-24 may witness a heavy recession on one side and a land slid or tremor in the international financial capital. Naturally, USA is now facing the crisis of depression. Bank’s failures are part its component of depression. Roaring right wingers do not have much knowledge about the recurring bank failures in the past. In 2008 (26 banks failed with a gross value of $31 billion) 2009(140 banks) 2010 (150) 2011(92).2012(51) 2018 (0) 2019(4) 2020(4) 2023(3 including SVB. Reason, when people wanted to withdraw their funds in panic, in Silicon Valley bank, it ran short of cash.

Their loan recovery, assets auctions are pending to pay their depositors. USA banks used to have their own risky game play with public money, and the regulatory authorities utterly abdicated their accountabilities to monitor them.

USA financial system, finance ministry play a Laissez–faire policy of total non-interference, leaving the fate of banks the fates of the banks in the hands of their board. So, ambition and secret conspiracy is injected in Indian economy. Madam FM wants covert the banks as richman’s casino.

There is much not difference between Indian regulatory authorities like RBI, SEBI or MCA and that of USA. Their supervision and controls are Laissez-faire. But, once caught in to trouble, western nations, do not bury the crimes. Huge penalties, years of prisons are almost determined while the frame of charges are done by the Regulatory authorities.

Reason- the corporates, once half dead will cause collateral damage to the financial system, with a chain reaction. Governments do abandon, their loyalty to crime prone corporate directors. The Federal Reserve will refuse to take a public dishonest status. Next question is, whether deterrent and criminal punishments are available to corporates in USA ? Yes, many had gone to jail. ‘Enron’ CEO in USA ,Mr. Kenneth. Jail 24 years. Bernard ,World com 25 years for various irregularities and frauds. Many more are counting the bars including banking company CEOs.

It is also a fact, companies had silently paid huge penalties in USA for violating their fianacial discipline. Rajat Gupta was jailed 2 years for inside trading and another Punit Dikshit of Mckinsey was awaiting for sentence of 20 years for share trade fraud.

Indian system is far more merciful. Madam finance minister, that RBI Act restrict disclosure of bank account information about Adani- she lies. There is no provision in RBI Act. Out of 543 Lok Sabha and 245 Rajya Sabha members, a few minus dead are dumb members of ruling party , other MPs are still harping, on how to out beat her intellectual lies. More we speak, will expose our impotency to confront a huge corrupt system rules from the North Block. Check it is written in the entrance, “Abandon all hopes-ye, who enter here” (by Italian poet Dante, in inferno -the gate of hell)

OK, What Is the Hindenburg (Analysis) Omen?

Hindenburg Omen or sharp technical signal, papered to send increasing storm signals to stock market. It compares the percentage of new 52-week highs and new 52-week lows in stock prices, the investors category, conditions, the percentage, that is supposed to predict the increasing likelihood of a market shock or crash.

Origin of the name was a plane crash that had occurred in Hindenburg Airstrip in 1937 in Germany due to technical error. So, the specific technical analysis on share market is not a new born term. Hindenburg study was done to large number of corporates capital market portfolio and corrections were done and many corporates faced market mayhem. If Hindenburg analysis or market research is done on many more company shares in the NSDL, there will be a huge chaos in Indian share market.

Hindenburg Research is a US-based research team that offers services in forensic financial research, with a focus on equity, credit and derivatives. Their fundamental research is often to study a share for investment in SHORT TERM SELLING. This necessitates them to study company balance sheets, their defects, accounting irregularities, unethical practices in business/related-party transactions, banking bad management, share price high and low, etc. This is a risk study for investment in short-selling. Many try to read it in our Indian financial colour glass and lecture. It is not so. Each functions, under their own legal and their corporate designed parameters. No one had observed that many of Indian companies, including ICICI Bank had paid huge fine/penalty for presenting defective balance sheets.

Another inquisitive question is, “Whether, such scientific parameters are observed by corporates in Indian market?” The answer is “Yes”. So many companies, especially many Indian MNCs ,do follow, to preserve their international reputations and image.

Take SEBI, it had played a village Panchayat role for all Adani’s cases against other companies on various investments and shares. Cases against were silenced with silencers and SEBI many times violated its regulations to safeguard Adani’s interest. In India, acts are for political comedy, the government officials, the rulers, and even some courts do join in this mock trials to make money.

Sebi levies Rs 20 lakh fine on individual for insider trading in Videocon

Sebi bans 8 entities from securities mkt in Infosys insider trading case

Sebi penalises compliance officer of Essar Shipping in insider trading case

Sebi confirms directions passed against entities in Infosys insider trading

Indiabulls Ventures CEO, 4 others pay Rs 5cr to settle insider trading case

It is not inside trading alone. The whole share trade is lead poisoned. Never a deterrent punishment forced them to taste Tihar jail food. Indian corporate leaders are having FIVE holy ghats to wash them of all their corporate sins. Non-disclosure of their frauds, plunder, economic offenses and criminal violations or collapse of their corporates. Their evils are pardoned by MCA, IT, SEBI, NITIAYOG and RBI. Their final Varanasi is PMO

Entire sins will be washed.

Subscribe to support Workers Unity – Click Here

(Workers can follow Unity’s Facebook, Twitter and YouTube. Click here to subscribe to the Telegram channel. Download the app for easy and direct reading on mobile.)